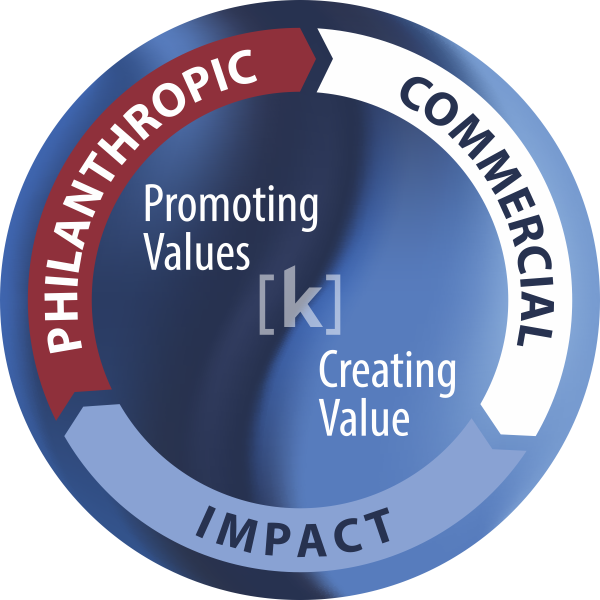

Creating Value and Promoting values since 1985

Our proprietary platform is built on the premise that pairing deep domain (industry) expertise with process (operational understanding) experts provides superior results. Founded in 1985 Kirchner Group has developed into one of North America’s leading boutique operationally oriented advisory firms. In our capacity as advisors, partners and principals we work in conjunction with management and their investors.

Today Kirchner Group operates various subsidiaries, providing advisory services (M&A, assessments, diligence) and operational support (interim management, workouts, turnarounds) as well as asset management (dedicated, underperforming funds).

Kirchner Group is a unique values-based corporate ecosystem maximizing individual and social benefit through our unwavering commitment to the thoughtful integration of ‘earning and returning’. Generating genuine value for our clients. To learn more about Kirchner Group’s returning activities click here.

A trusted, one-stop resource

Kirchner Group works with companies through their entire lifecycle to provide the necessary support at all stages of growth. Kirchner Group’s clients and partners include early stage to mid-market companies, venture capital and private equity firms as well as family offices and some of the world’s largest insurance companies, commercial banks and institutional investors. Everything we do and how we do it stems from an entrepreneurial culture built from real world experience. Let our experience go to work for you.

People

Founded in 1985 by W.B. Bud Kirchner, Kirchner Group is comprised of successful seasoned entrepreneurs, advisors and executives. Kirchner Group has more than five centuries of collective experience. In addition to our numerous process experts we are unique in having numerous resident domain experts.

Values

Kirchner Group is guided by the following fundamental values.

Philanthropy

Giving back is something we feel strongly about. We are proud to support the Christopher Douglas Hidden Angel Foundation and the Hidden Angel Companion Pets.

Impact

We are driven by the belief that you can do good while doing well and are committed to impact activities such as impact investing through our Impact Foundation.

Community

Relationships are at the very core of our success. We proactively cultivate honest, positive and enduring relationships with our clients and stakeholders.

Diversity

We are committed to promoting diversity and inclusion in terms of race, gender and other inequalities.

Respect

We are committed to treating everyone fairly and equitably – both our clients and our team.

Accountability

We feel an obligation to create value and be rewarded accordingly.

Integrity

We place our clients best interest before our own but will never waver from doing the right thing.

Excellence

Everything we do is measured against the highest standards and best practices.

Tradition

We have been in existence for more than 30 years and we value our heritage, success and strong reputation.

Commitment

We push ourselves extraordinarily hard to ensure that we fulfill and exceed our commitments.